Financial Navigation Can Reduce the Financial Toxicity of Cancer Care

, by Carmen Phillips

Results from a new study add to the evidence that programs aimed at reducing the financial burden of cancer treatment can save money and improve the quality of life of people with cancer and their loved ones.

In the study, supported in part by NCI, people undergoing treatment for cancer and their caregivers who participated in a financial navigation program saved an average of about $2,500 each. The results were published March 8 in JCO Oncology Practice.

The study focused on the harmful impact of the cost of cancer care, often called financial toxicity, specifically for people with blood cancers such as leukemia and lymphoma.

Blood cancers are among the most expensive to treat, said the study’s lead investigator, Jean Edward, Ph.D., R.N., of the University of Kentucky Markey Cancer Center, where the study was conducted.

Treating these cancers often involves bone marrow transplants, grueling treatments that require extended hospital stays and managing potentially deadly side effects like graft-versus-host disease. People who get a transplant also need caregivers who can be regularly available for an extended period.

That’s why it was important to include caregivers in the study, Dr. Edward said, noting that “their financial toxicity and hardship increases as their loved one gets sicker or if they have lost a partner [to cancer].” Dealing with cancer’s economic costs, she continued, “is often a shared responsibility.”

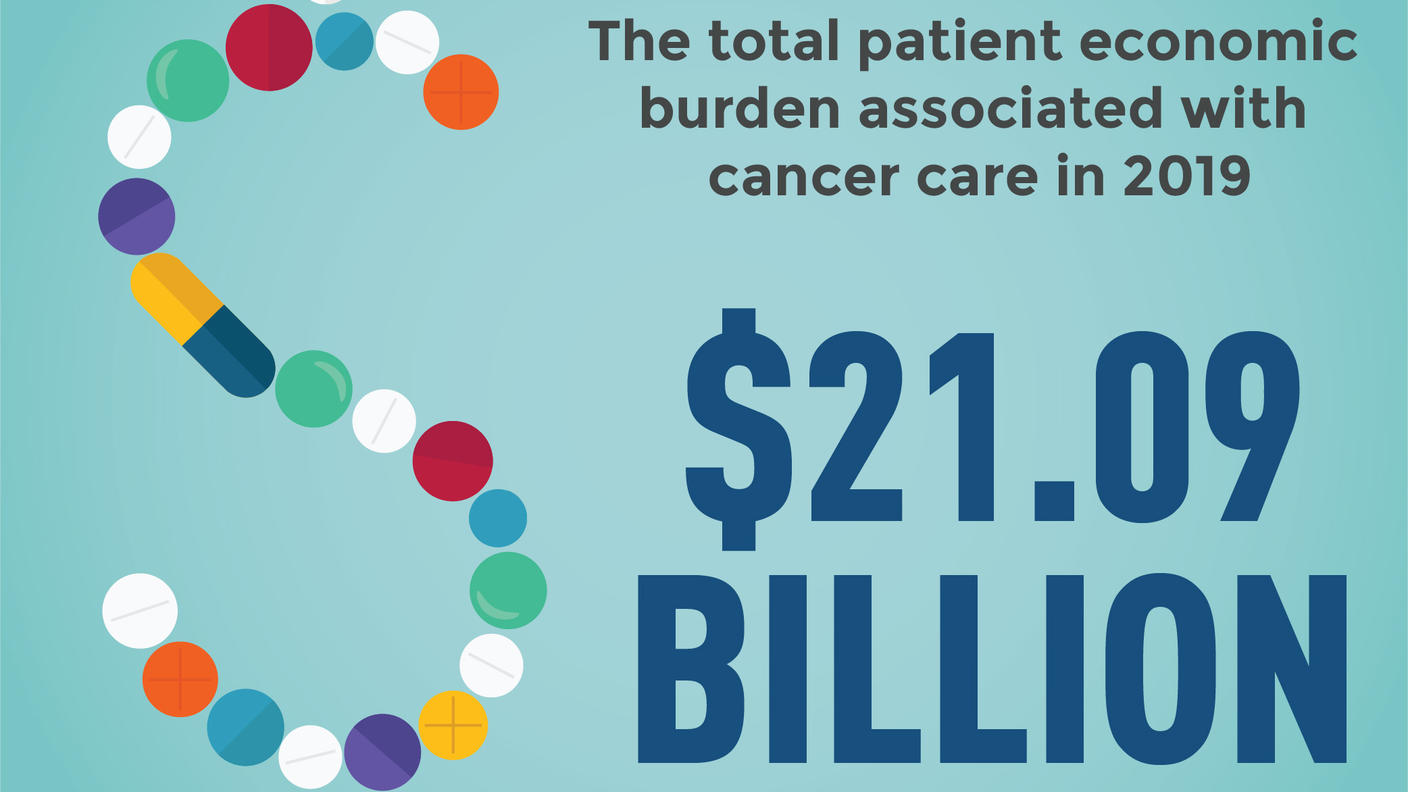

Financial toxicity has become one of the most pressing issues facing cancer patients, their families, and clinicians who treat cancer, said Janet de Moor, Ph.D., M.P.H, of the Healthcare Delivery Research Program in NCI’s Division of Cancer Control and Population Sciences.

From large cancer centers to small community hospitals, Dr. de Moor said, “there’s growing awareness that many patients experience financial hardship as a result of their cancer, that it has important downstream impacts for their families, and that [they] need to do something about it.”

Bankruptcies, foreclosures, and more

Over the past few years, numerous studies have documented the impact of the high cost of cancer care in the United States. For example, a 2022 study showed that people with cancer were 2.5 times more likely to file for bankruptcy than people not being treated for the disease.

Another 2022 study found that three-quarters of people being treated for colorectal cancer had what they described as serious financial hardship during the first year of their diagnosis—even though nearly all of the study’s 380 participants had health insurance.

“Insurance doesn’t protect people with cancer against financial hardship,” said the study’s lead investigator, Veena Shankaran, M.D., M.S., of the Fred Hutchinson Cancer Center.

The financial chaos can seep into day-to-day life, causing severe distress and life disruption. For example, a Kaiser Family Foundation survey of people with cancer or who had family members with cancer found that many reported having to drain their savings, buy less food, and change their living situations.

“The scope of the [financial toxicity] problem is vast,” Dr. Shankaran said.

But some cancer centers and hospital systems are taking steps to warn patients about—and help them manage—the potential financial impact of their care. One study of community cancer centers in the NCI Community Oncology Research Program, for example, found that about half had a financial navigator.

And researchers at several large NCI-Designated Cancer Centers recently tested a system for screening patients with metastatic cancer for worsening health and financial problems. Having this monitoring system in place, they found, substantially reduced patient reports of developing or experiencing worsening financial hardship.

On a larger scale, in 2019 the Levine Cancer Institute in North Carolina created a financial toxicity tumor board. The board—which consists of oncologists, nurses, patient navigators, financial counselors, and social workers—meets regularly to discuss hospital-wide operations and services that can help patients experiencing financial toxicity.

A team from Levine reported that the board’s work had helped patients treated at the center avoid up to $60 million in costs, including credits for drug costs and insurance co-pay assistance, over 2 years.

Saving money and reducing distress

For the study at Markey Cancer Center, Dr. Edward and her colleagues enrolled 54 patients being treated in the center’s Division of Hematology and Bone Marrow Transplant program and 32 of their caregivers.

To conduct the study, nursing staff or medical assistants used two different tools to screen for financial toxicity in patients. One of the tools, called COST, was developed specifically for identifying people experiencing financial toxicity.

Financial Toxicity Affects Caregivers’ Quality of Life

The quality of life of those closest to people with cancer can be affected substantially by the financial burden of cancer care, according to a new study. The researchers surveyed colorectal cancer survivors and their partners/caregivers about the financial impact of the survivors’ cancer, including measures for quality of life.

The study findings, published April 6 in JAMA Network Open, showed that nearly 70% of partners/caregivers reported experiencing financial problems, including debt and worry about finances. The financial problems harmed their quality of life, including causing sleep loss, fatigue, increased pain, and disruption of social activities.

Nearly 1,200 patients and caregivers were screened during the study period (April 2021 to January 2022), of whom nearly 300 were “positive” for financial toxicity and invited to participate in a financial navigation program called CC Links.

Only about 25% of patients agreed to participate, while all caregivers of the participating patients who were invited agreed to be part of the study. Nearly one-third of participants had an income below the federal poverty level, the Markey team reported, but nearly all participants had health insurance.

Through the CC Links program, study participants consulted regularly with a financial navigator through in-person visits, phone calls, and email. In addition, the navigator used a tool that regularly surveyed participants specifically about cancer-related financial fallout (e.g., having to borrow money, filing for bankruptcy).

The most commonly reported financial concerns throughout the study were out-of-pocket costs for care, Dr. Edward and her colleagues found.

Navigation was able to help with some of those costs: In total, the financial navigator helped participants secure about $125,000 in financial aid—often in the form of grants—to cover costs of things like travel and drug co-pays and to provide direct financial assistance.

The only substantial improvement for patients was in financially related distress, the team reported, while caregivers reported overall reductions in financial toxicity as well as financially related distress.

“We were really happy to see that [financial navigation] reduced financial toxicity,” Dr. Edward said. But what the published results don’t capture “is all of the positive feedback we got about the financial navigation from patients and caregivers and the continued relationship [the navigator] had with these individuals.”

It was disappointing, but not necessarily surprising, that so few patients chose to participate, Dr. Edward said. People with cancer are often focused on their treatment, including dealing with side effects. So, initially at least, financial matters often take a back seat, she continued.

“People can be overwhelmed with their own medical care,” Dr. Shankaran agreed, particularly the patients included in the Markey study. “This was a sick population” of patients, she said.

It’s also not unexpected that caregiver participation was so strong, she added.

Their inclusion was “a beautiful thing about this study,” Dr. Shankaran said. “The team recognized that it’s not just the patient who’s affected by financial hardship, it’s the caregivers as well.”

Impact on cancer outcomes, more studies on the horizon

The financial impact of cancer care goes even beyond extreme hardship like bankruptcy or losing your house, Dr. de Moor said. Many studies have found that the high cost of care causes many people to delay or skip treatments or miss appointments. And several studies have linked cancer-related financial hardship and filing for bankruptcy to earlier death.

So the finding that financial navigation can help limit financial toxicity is good news, Dr. de Moor added. But more research is needed, and some is on the way.

Dr. Edward and her colleagues are expanding their work, including launching a study that will add legal guidance to the financial navigation. And Dr. Shankaran is leading an NCI-funded nationwide clinical trial testing the impact of a financial navigation program on both patients and their caregivers.

A major question moving forward is the extent to which efforts to reduce financial toxicity will be integrated into the health care system more broadly. The hard reality, however, is that return on investment is part of the calculus for any hospital thinking about providing services like financial navigation, Dr. Shankaran acknowledged.

Part of proving the business rationale for financial navigation will require continued research, Dr. de Moor said. “It means working to scale up approaches that … are demonstrated to be effective,” she said. Effective financial navigation can be labor intensive, she continued.

“So developing ways to streamline [navigation], testing different delivery approaches, through a technology solution, for example. There hasn’t been a lot of work on that front, but … it could be useful.”